Crypto-currencies and Hyper-dollarization

Part 1 /2

Introduction

The purpose of this arcticle is to hypothesize the effects of hyper– dollarization which is accelerated by crypto-currencies to the Sub-Saharan countries. Before the hypothesis, a few definitions must be made.

Crypto-currencies: crypto-currencies are digital forms of value that use cryptographic techniques to secure their integration. As for this arcticle the crypto-currencies refer to both tokens and coins

Hyper-dollarization: Hyper dollarization is the increase in the number of countries that use the U.S dollars as a default currency or substitute instead of the local (domestic) currencies. As for this arcticle the main focus will be on Sub-saharan countries.

Hypothesis

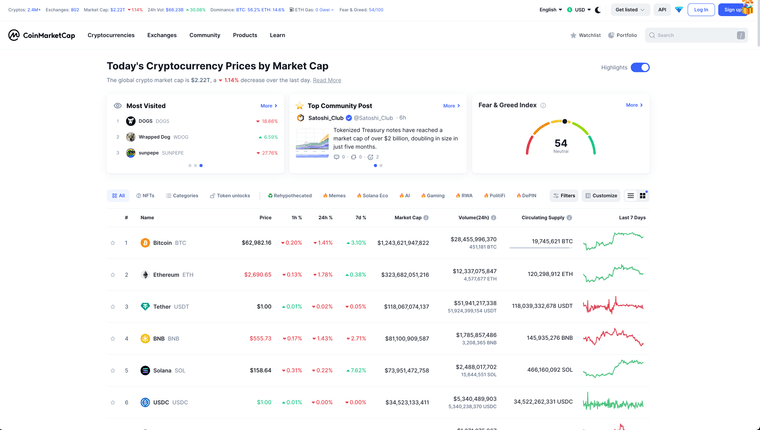

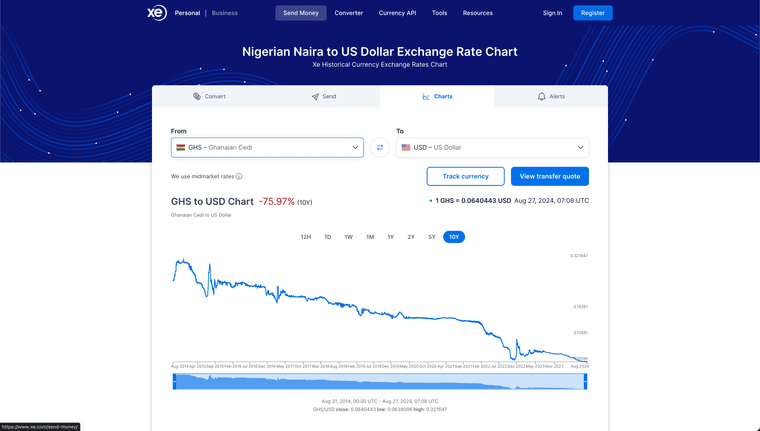

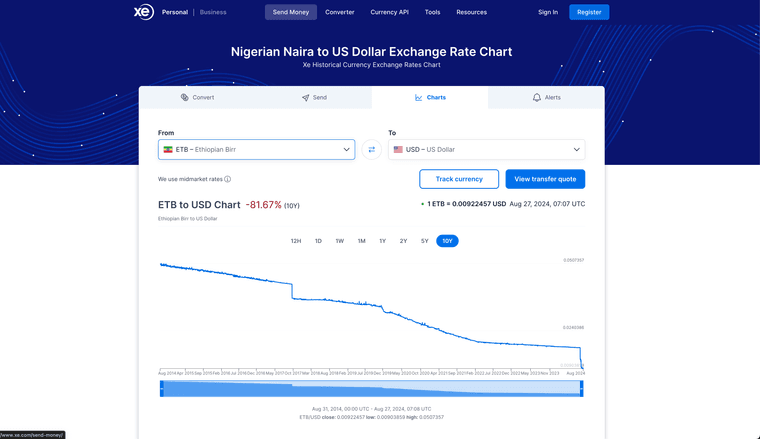

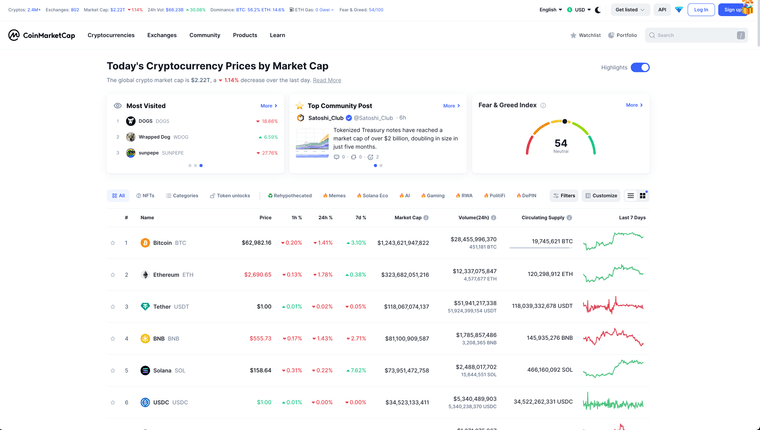

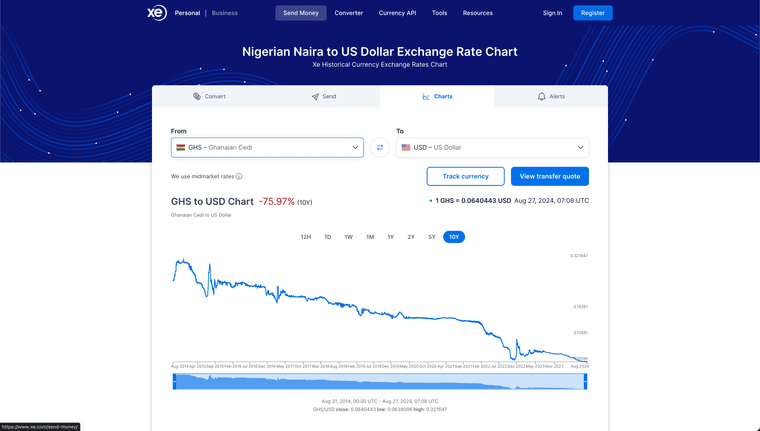

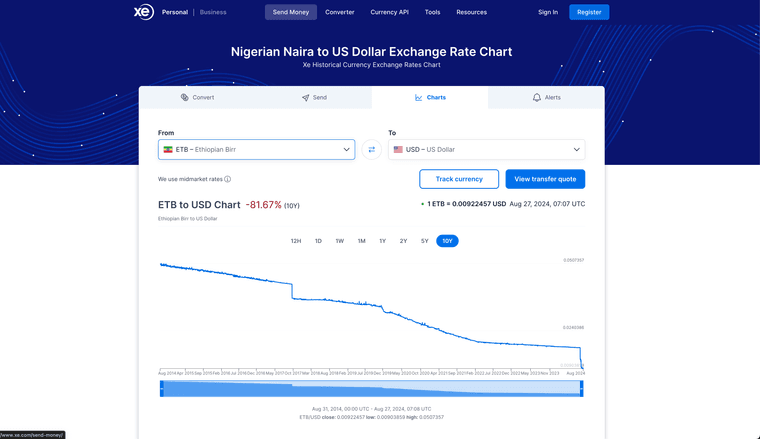

With the increase in global inflation, currency instability is one among the major problem facing most economies in the world. This can also be viewed as all Sub-saharan domestic currencies are losing purchasing power against the Us dollar

Ghana

Ethiopia

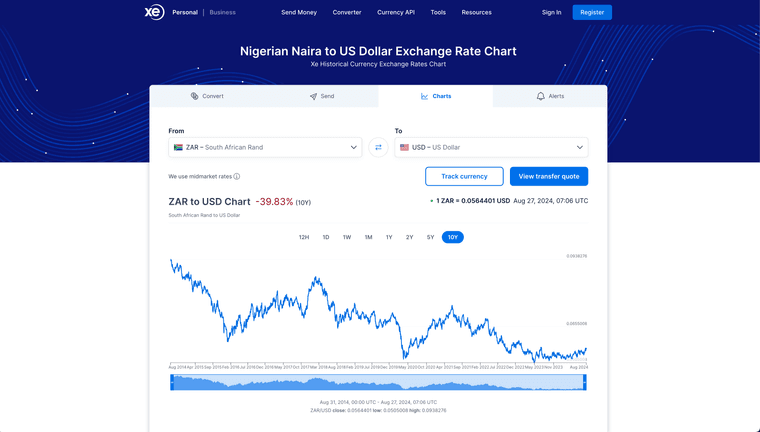

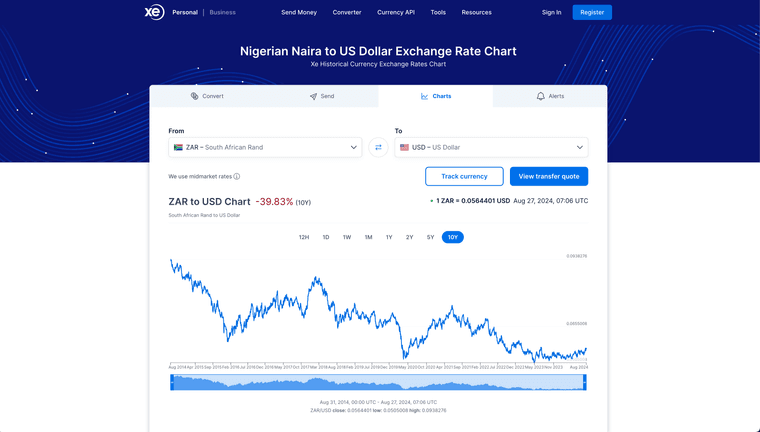

South Africa

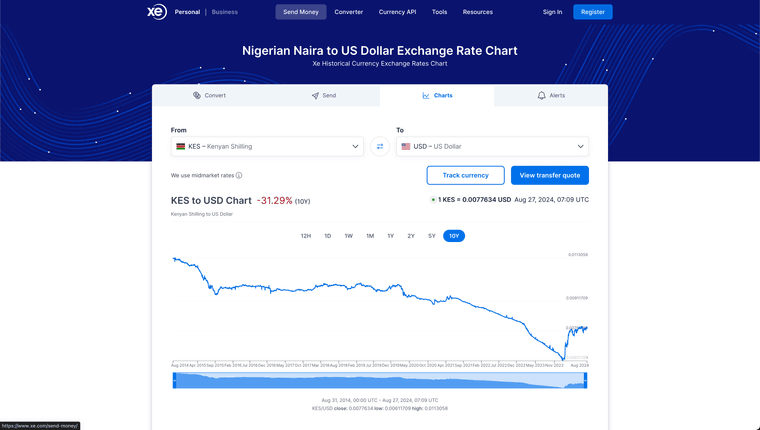

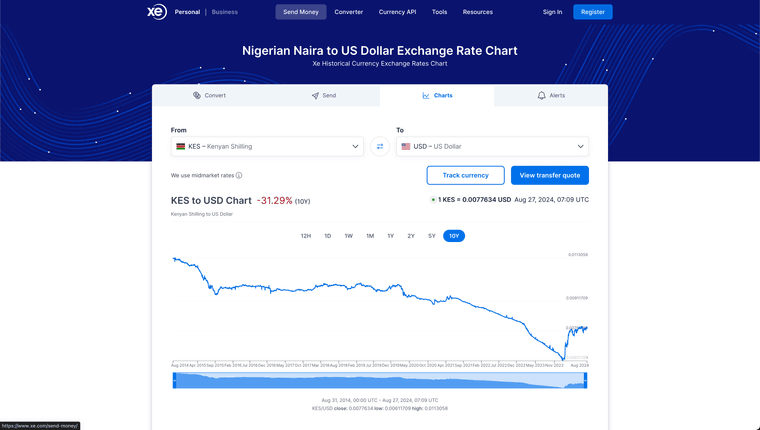

Kenya

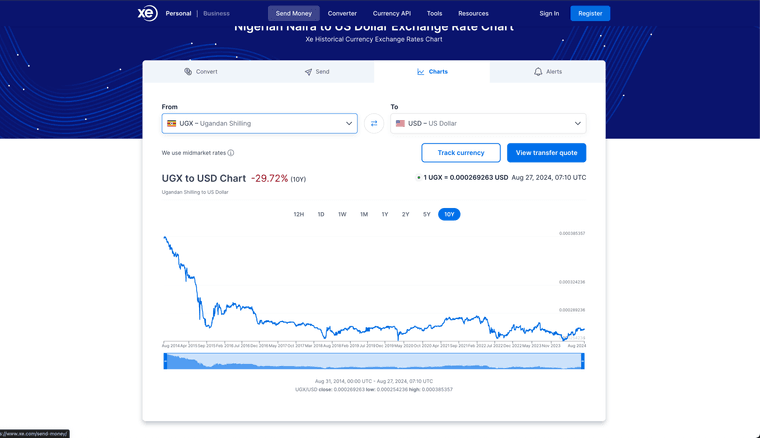

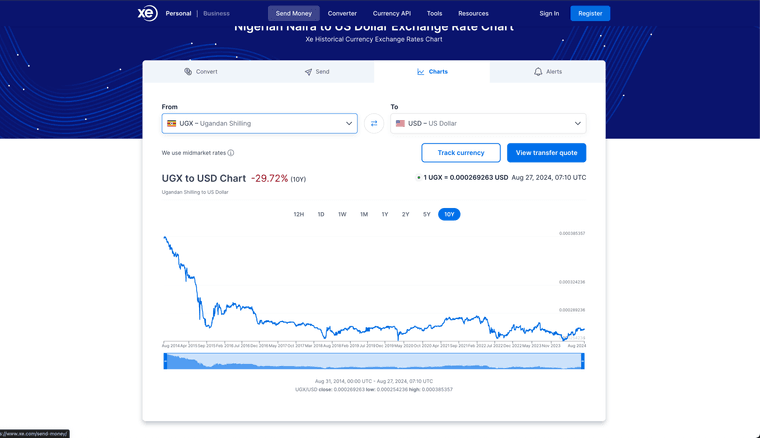

Uganda

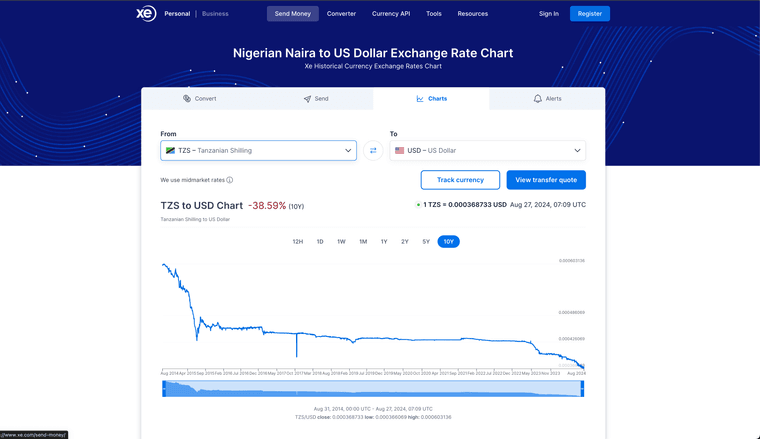

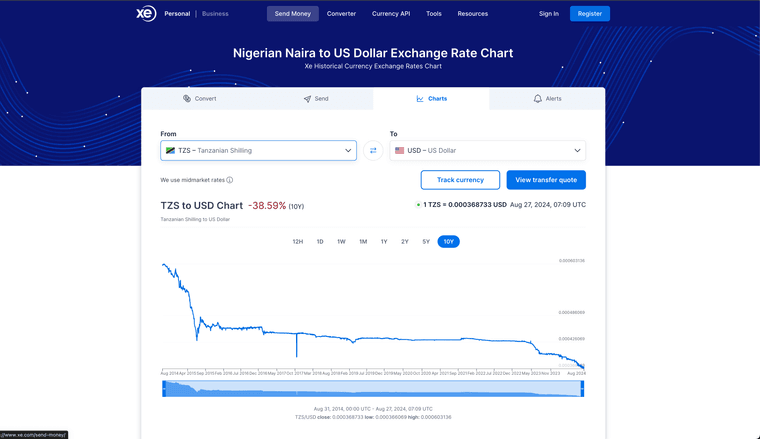

Tanzania

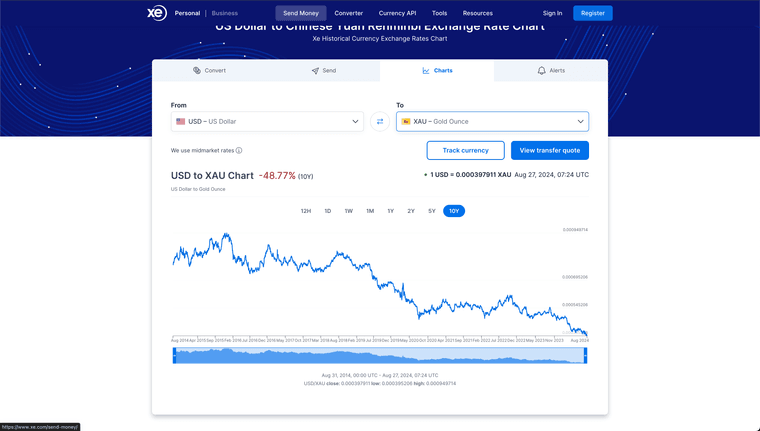

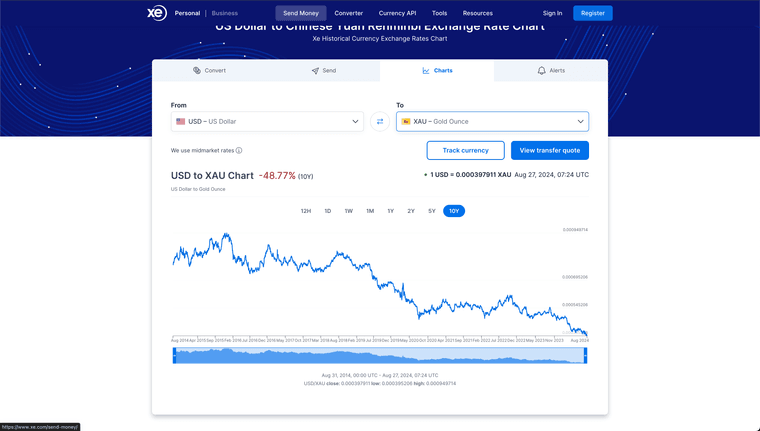

Unlike other countries, the U.S dollar also faces inflation but manages to pass the inflation to the global economy due the U.S dollar unique reserve currency status. This is done by the Federal Reserve and the Treasury a form monetary policy known as QE quantitative Easy. This is used to stimulate the U.S economy by reducing interest rates allowing the easy follow of capital (allow business and individual to cheap loans). To clearly see the lose of Us dollar purchasing power one has to use a scarce assets such as Gold or Oil to see the Us dollar losing purchasing power

The Us Dollar vs Gold

Due to the U.S dollar being the world’s Reserve currency and most of the countries around the world using it for international trade. The U.S QE monetary policy affects the global economy increasing the number of dollars in circulation which causes inflation in prices of commodities around the world making domestic monetary policies null and void. Inflation is then passed on the local economy causing a rise in imported goods and commodity prices; since the imported commodities are mostly done is dollars, the dollar is seen as a favorable currency to the local currency. During this inflation period the local currency loses its value making people who want to store their value lose a lot due to inflation hence the dollar is seen as a hedge against inflation.

Form the observation above, a hypothesis can be made as follows;

As the U.S continues to stimulate Her economy using Q.E, this process will lead to increase in imported goods and commodity prices and cause a massive devaluation of most local / domestic currencies of Sub-saharan countries; this will inturn force most Sub-saharan residents to leave their local / domestic currencies to the dollar inorder to save their purchasing from constant devaulation.

Crypto-currencies

For a longtime most Sub-saharan governments have regulated the supply of Us Dollars to combat capital flight using various policies and laws to ensure the dominance of local / domestic currencies.

Crypto-currencies and tokens (Stablecoins) in particular offer an interesting challenge. From the above hypothesis, Hyper-dollarization in Sub-saharan countries will likely occur in parallel with once the following key conditions;

- The US QE.

- Adoption of crypto-currencies.

- The need of a saving purchasing power.

Where as in the past dollarization of Sub-saharan Tradfi (tradition finance) was controlled due most of the dollar entry points where known and regulated by the government, Defi decentralized Finance is formed by semi to fully decentralized individuals. Anyone participate in Defi and the underlying currency used is the dollar.

Based on this: I can predict that most sub-saharan redistants will earn money using there domestic / local currencies, pay taxes to the government and other government servicies domestic / local currencies but they will save using stablecoins backed by the US Dollar via Defi instruments to save there purchasing power and secondary economy will be formed where Us backed stablecoins will be used to pay for goods and services

Note: This is not financial advise